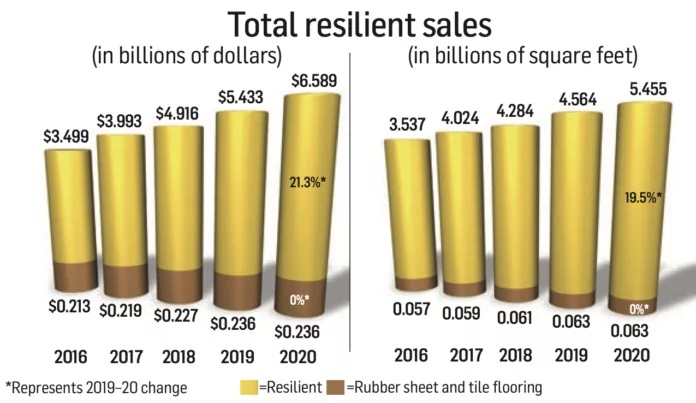

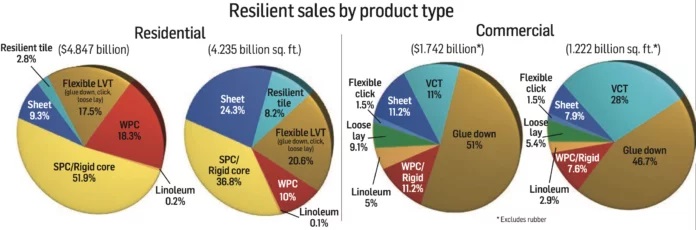

By Megan Salzano While 2020 was anything but ordinary, there was one thing the flooring industry could count on: the continued popularity of the resilient category. It will come as no surprise that resilient—led mostly by the rigid core/SPC sub-segments—once again registered gains while many other flooring categories in 2020 did not. FCNews research shows the category generated $6.589 billion in sales (not including rubber) in 2020—an industry-leading 21.3% increase over 2019’s $5.433 billion. In terms of volume, the category accounted for 5.455 billion square feet (not including rubber) at the first point of sale, a 19.5% increase from 4.564 billion in 2019.

The resilient flooring category’s strong performance in 2020 is even clearer when measured against the hard surface market. When compared to ceramic tile, hardwood, laminate and other hard surface materials, resilient accounted for 50.6% of sales vs. 2019’s 45.1%. When taking total flooring sales into account, resilient comprised 28.7% of dollars and 28.8% of volume, compared to last year’s 24.6% and 24.2%, respectively. Over these last several years, resilient’s share of the market has more than doubled in terms of dollars and increased by nearly half in terms of volume.This positive momentum, executives say, is directly attributed to the category’s performance, ease of installation and cost of entry—as well as changing consumer habits accelerated by the pandemic.To justly analyze the resilient flooring category in 2020, it would be difficult without looking at the consequences of the COVID-19 pandemic—a truth for any product category in the building materials or home improvement industries. For the flooring industry itself as a whole, the stay-at-home lifestyle created by the lockdowns during the early stages of the pandemic in the U.S., while initially setting off a whirlwind of doubt, gave an unprecedented boost to sales in the second half of the year.

Suppliers agreed, as consumers spent more time in their homes they began to more quickly point to updates and renovations needed within those homes. In addition, consumer spending and financial reserves traditionally earmarked for travel, leisure and entertainment— which were on hold for most of the year and into 2021—were now readily available to be put toward home renovations. In essence, it created overwhelming demand. “COVID-19 changed the dynamic, which we’re still seeing post-COVID-19, where there is just an incredible amount of home improvement business taking place,” said David Sheehan, vice president residential resilient, Mannington. “There clearly is an insatiable drive that is directly pandemic related where consumers are looking to remodel. Every category, for the most part, saw pretty significant growth for the second half of 2020, and we’re still seeing that same phenomenon in 2021.”

For the resilient flooring category, the quick turnaround time needed to reshape existing spaces into work-from-home or learn-from-home areas—regardless of purchase process—was an added advantage. “The nature of click together flooring in resilient really lends itself to the end user being able to make a quick transition,” said Ed Sanchez, vice president of product management, resilient, Mohawk. “Whether they are updating the room themselves as a DIYer or using an installer, they are very quickly able to transition a room vs. tile or hardwood where it’s a much longer process.”In addition to its ease of installation, updated designs and performance within the LVT segment have contributed to the category’s growth. “Rigid core luxury vinyl products offer the consumers a number of opportunities,” explained Richard Quinlan, senior vice president of sales and marketing, Wellmade Performance Flooring. “Visual designs throughout the LVT category continue to improve and rival the look of real hardwood as well as tile and natural stone, all at lower prices than the real thing. Ease of installation and the benefit of durable resilient flooring round out the value opportunity, making the decision to buy LVT a very logical choice.” A major benefit of resilient flooring—and a subsegment of its performance—is its waterproof claims. “Piet Dossche, [founder of USFloors and the COREtec brand] found something that really resonated with the consumer, which was waterproof,” explained Drew Hash, vice president hard surface product and category management, Shaw Industries. “Obviously, that has been a big part of why resilient flooring has become what it has, because of that waterproof story.”

Hash went on to add that while waterproofing is a driver of growth for resilient flooring, the category’s value proposition—a.k.a. pricing—is equally important. “A lot of the consumers who entered the market over the last 12 months were first-time buyers and first-time remodelers,” he said. “What you get for what you pay for certainly resonates as to why the category continues to grow from a residential perspective.”

Suppliers also agree that the resilient flooring category has grown in terms of awareness among consumers as well as in acceptance by RSAs. “I think you’ve seen a shift in the last couple of years where consumers are now aware of the category and they’ll say things like ‘waterproof flooring,’” Mannington’s Sheehan said. “In many instances, I’m convinced that consumers will gravitate toward wood or stone and then they will go into the store and they will leave buying rigid/LVT. Because they are in the buying cycle for a floor every five to seven years, they don’t know the business and they trust the RSA; and the RSA is so aggressively selling them on the notion of waterproof and rigid flooring. There is excitement and enthusiasm that RSAs have for the category that is driving some of that growth.”

.jpg)

SPC Segment Continues to Lead the Charge

22/11/2021 Tác giả : Nguyễn Giang

Chia sẻ